CCIM + STDB Webinar Recap: The Fastest Path from CRE Research to Opportunity

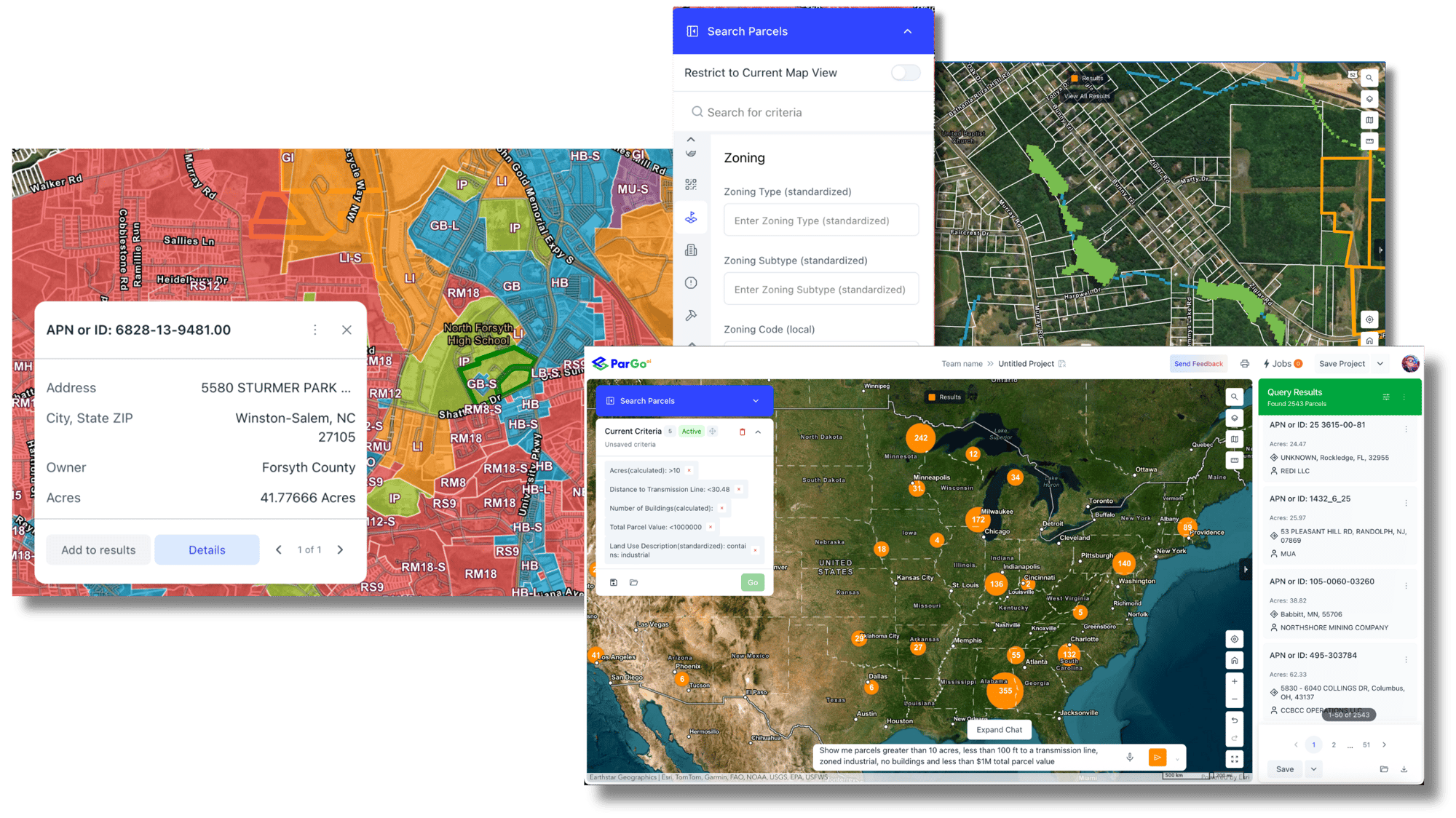

Discover how ParGo AI's geospatial intelligence transforms CRE property analysis, speeding up research and uncovering opportunities in minutes. Learn...

ParGo AI is the market-leading property and location-intelligence platform for banks, combining nationwide, parcel-level data and AI to accelerate lending and underwriting decisions while surfacing risk signals earlier across the portfolio.

Give underwriting and credit teams a efficient, defensible view of collateral risk with unified ownership, lien, zoning, permit, and market intelligence, delivered instantly by ParGo AI.

ParGo consolidates collateral data that normally requires multiple vendors, ownership, liens, zoning, permits, and market context, into a single, instantly accessible view.

Surface ownership complexity, permit gaps, land-use constraints, and market changes that traditional appraisal and AVM workflows often miss.

Move beyond static credit memos with real-time monitoring of collateral and market signals across the life of the loan.

As a market leader in property intelligence here are some ways that ParGo could assist in existing workflows.

Instantly analyze any property backing a loan.→ Validate ownership, review zoning compliance, identify environmental or land-use risks, and assess recent construction or permit activity before credit committee review.

Trace through LLCs and layered entities to identify true beneficial owners.→ Reduce borrower opacity and strengthen KYC, guarantor, and sponsor analysis.

View recorded mortgages, liens, assignments, and releases in one place.→ Quickly confirm lien position and identify competing claims on collateral.

As a market leader in property intelligence here are some ways that ParGo could assist in existing workflows.

Evaluate collateral within its real market environment.→ Review recent sales, lease activity, and development trends to support valuation and risk assumptions.

Analyze permit history and ongoing construction signals.→ Understand whether collateral is improving, stagnating, or deteriorating over time.

Track your entire loan book for material changes—ownership transfers, listings, permit activity, or local market shifts.→ Identify emerging risk before it becomes a credit event.

1 - Input the asset or portfolio. Search a single address or upload a loan list.

2 - Assess risk factors. AI highlights anomalies such as ownership changes, zoning conflicts, or permit inactivity.

3 - Monitor continuously. Save assets or portfolios to receive automated alerts.

Discover how ParGo AI's geospatial intelligence transforms CRE property analysis, speeding up research and uncovering opportunities in minutes. Learn...

| Category | Sample Insights |

|---|---|

| Property & Ownership | Current owner, ownership history, LLC resolution |

| Mortgages, Liens & Encumbrances | Recorded loans, lien types, releases, foreclosure indicators |

| Zoning & Land Use | Compliance with current use, entitlement constraints |

| Permits & Construction | Improvement history, renovation gaps, project values |

| Environmental Layers | FEMA flood, wetlands, slope, soil & climate risk |

| Sales & Lease Comps |

Recent transactions and lease benchmarks |

“Pargo improves speed, efficiency, risk management and monitoring at every step of the lending and collections process. There is nothing else like it.”

“What took us 3 months now takes us 3 minutes.”

“Our team has been waiting for a platform that could match even a portion of ParGo’s capabilities.”

Unified collateral intelligence: All key property risk data in one platform

GeoAI change detection from imagery for real-time construction insight

AI-assisted risk surfacing: Highlights what matters, not just raw data

Consistency across teams: Standardized views reduce analyst variability

Efficient scale: Replace multiple vendors with a single intelligence layer

Data updated as frequently as possible ensuring the most relevant models

ParGo complements appraisals, AVMs, and third-party reports by providing fast, unified collateral intelligence early in underwriting and ongoing monitoring after close.

No. ParGo is not an appraisal tool—it is a risk and intelligence layer that helps underwriters validate assumptions, identify red flags, and contextualize valuation inputs.

Yes. Many banks and lenders use ParGo to monitor entire loan portfolios for ownership changes, new construction activity, or market shifts that may affect credit exposure.

ParGo aggregates authoritative public records and continuously updates them, giving credit teams a current, defensible view of collateral conditions and changes.